A Simple Key For Chapter 7 Bankruptcy Unveiled

One way to prevent bankruptcy is to acquire a lower interest charge personal loan and repay all that really high priced credit card debt. Upstart recognizes that a credit rating rating isn't the sole element to think about when evaluating your bank loan software.

Chapter seven is additionally The most affordable bankruptcy chapter to file as well as fastest to complete, generally using four months. This text clarifies what this means to file for Chapter seven bankruptcy so you can decide no matter if it will be just right for you. Also, to assist you far better understand how Chapter 7 functions, we've integrated illustrations with links to associated bankruptcy forms.

Determine shoppers that have submitted for bankruptcy the moment the next day, including significant dates for filing statements and also other courtroom paperwork.

Family members legal issues might be nerve-racking and exhausting. Your provider business will provide the encounter to assist secure the best possible final result.

The complex storage or accessibility that's used completely for statistical needs. The specialized storage or obtain that is definitely employed completely for anonymous statistical purposes.

, a principal reason on the bankruptcy act would be to "ease the honest debtor from the burden of oppressive indebtedness and permit [them] to begin afresh absolutely free from” prior “misfortune.” Appropriately, chapter seven “will allow an individual who's overcome by financial debt to get a ‘fresh new begin’” by way of a discharge of their debt by surrendering for distribution the debtor’s nonexempt home.

Harness the strength of State-of-the-art analytics and device Understanding algorithms seamlessly integrated right into a consumer-friendly interface, personalized to satisfy the special click here now data requires of your respective Business.

Completely. Countless individuals use credit card debt consolidation courses each and every year to deal with their toughest credit score troubles. It's a good idea to check out the reputation of any program you're looking at: determine what other purchasers say regarding their experiences, see if the BBB has rated the corporation, and ascertain on your own if their debt consolidation products and services are worthy of your time and efforts and (probably) money.

Against this, in case you are wounded in an accident that occurs before you decide to file for Chapter seven, any insurance policy proceeds payable to you will be likely house within your bankruptcy estate. You'll need to get the subsequent move of figuring out If they're exempt to find websites out if you will get to maintain them.

For people struggling with personal debt and tax obligations, bankruptcy can offer a route ahead, nonetheless it demands thorough preparing and adherence to lawful and tax specifications.

to concur with out offering consent being contacted by automated suggests, text and/or prerecorded messages. Charges may possibly utilize.

Suppose you Will Filing Chapter 7 Bankruptcy Ruin My Life may protect the equity by using a homestead, motorized vehicle, or wildcard exemption. If you financed your property or car or truck and remain creating payments, you should meet up with A go further requirement. You need to also be latest over the monthly payment.

In contrast, Chapter thirteen bankruptcy, generally known as a reorganization bankruptcy, lets you develop a repayment intend to spend back your debts over a few to 5 years.

Needless to say, you would likely do improved selling the property for a higher cost here are the findings just before bankruptcy and paying out the financial debt oneself. Even so, due to the fact house income ahead of bankruptcy are meticulously scrutinized, check with a bankruptcy attorney just before making use of this technique.

Haley Joel Osment Then & Now!

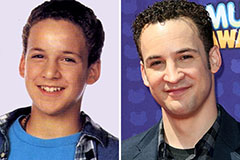

Haley Joel Osment Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!